Delta Airlines Travel Insurance - 2024 Review

Delta Travel Insurance

7

Strengths

- Available at Check-Out

Weaknesses

- No Medical and Medical Evacuation Coverages

- Insufficient Travel Insurance Coverage

Sharing is caring!

Delta Airlines is one of the top US airlines and has the distinction of being the most awarded US airline. According to Delta’s website, “The Frequent Traveler People’s Awards has recognized Delta SkyMiles as the Americas’ top loyalty program in four of its five award categories, including best customer service and program of the year for 2021”..

As with so many other airlines in the USA, Delta Airlines Travel Insurance is part of the Allianz Travel Insurance family of trip insurances. What does their policy cover and should you purchase it? Let’s take a look and see what they offer and then compare it to what we can find in the open marketplace.

Our Sample Trip

For our review, we chose a roundtrip flight from Dallas, TX to London, England on Nov 6 – Nov 30 for two adult travelers. The website shows us each of the various fare categories at a glance for the departure time selected:

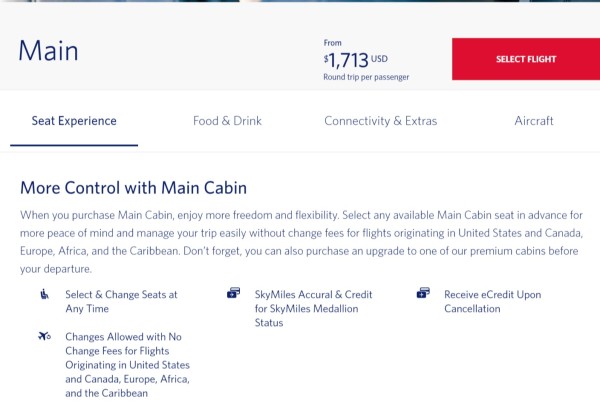

The various fares, and what is provided with that fare, can be reviewed by clicking on the name of the fare above the price.

There’s a $182 price difference between Main Economy Class ($1,713) and Main Economy Delight ($1,895) for our flight. What’s the difference?

Looks like we get a bit more legroom and free seat selection for our $182. But that’s it.

If we opt for Main Refundable Premium at $3,904, we’re looking at a $2,009 increase from Economy Delight. What’s included here?

Essentially, we get refundable tickets and more Sky Miles for our extra $2,009 cost.

Finally, we can opt for First Class at $7,787. That’s a huge jump of $3,883!

After considering our options, we chose the Economy Delight fare for departure and the Comfort + for the return flight.

Our final cost with taxes and fees comes to $3,788.96.

Finally, after seat selection and right before checkout, we are asked if we’d like to purchase travel insurance for the trip at $142.09 per traveler:

The policy provided is Allianz’s International Trip Protector V. The premium for the insurance sounds quite reasonable - $142.09/traveler for a total of $248.18. But what benefits are provided for that premium? If travelers live in any state besides NY, here are the benefits:

New York travelers have additional Travel Delay benefits of $200 (daily max of $150) with a required minimum delay of 6 hours. Otherwise, the benefits are identical to the shown benefits for other states.

The Allianz policy covers trip cancellation and trip interruption, both up to 100% of the trip cost per traveler. Lost or damaged baggage is covered as well. The policy offers $50,000 of emergency medical coverage and the same amount for emergency medical evacuation. Coverage can also be provided for pre-existing medical conditions if the insurance is purchased within 14 days of the initial trip payment date. Exceed that purchase window and pre-existing conditions are not covered and the company will look back 120 days from policy purchase to see if the traveler has a pre-existing condition that would not be covered.

While most of us have medical insurance at home, it often doesn’t cover us out of the country. Therefore, having adequate medical coverage in your travel policy is important when we travel.

Medical evacuation coverage gets us to a hospital that can treat us when we are severely ill or injured. This type of transportation can be extremely expensive, which is why travel insurance should provide enough coverage to get us home in a medical emergency.

Now that we’ve seen what Allianz will provide for insurance for our trip, let’s see what the open marketplace can provide.

Marketplace Options For Trip Insurance

CruiseInsurance101 is a travel insurance marketplace. We work with some of the largest trip insurance carriers in the country. We provide your travel details to them, and they provide binding quotes back which we sort in price order then highlight a plan we recommend for your trip. You don’t have to waste time shopping for quotes from individual companies.

Using CruiseInsurance101’s quoting tool and inputting our trip details, we are presented with 25 policies to choose from. For international travel, CruiseInsurance101 recommends having at least $100,000 in medical coverage and $250,000 in medical evacuation coverage. A waiver of pre-existing medical conditions is also recommended if needed.

The least expensive plan for our trip with adequate medical coverage is the IMG Travel SE at $358.04, which is the total cost for both travelers combined.

The policy provides the same 100% refund for trip cancellation as the Allianz policy and the same 150% refund for trip interruption as Allianz. More importantly, the IMG policy provides $250,000 of medical coverage per traveler and $500,000 of medical evacuation coverage per traveler – much more than Allianz’s $50,000. Coverage is available for pre-existing medical conditions if we purchase the policy within 20 days of our initial trip payment or deposit.

While the Allianz policy provided by Delta will only cover the airfare cost, travel insurance in the marketplace can include not only the airline tickets, but any other non-refundable trip costs such as hotels, tours or excursions or transportation tickets.

With the IMG policy, we’re getting more benefits and if needed, we can also cover our complete trip and not just the air portion!

Cancel for Any Reason Policies

If we want flexible cancellation options, we have other choices as well when shopping in the marketplace. Cancel For Any Reason (CFAR) policies allow cancellation for any reason whatsoever and still receive either a 50% or 75% refund of the trip costs (depending on the policy purchased).

Looking at our quote from CruiseInsurance101, the least expensive CFAR policy with the highest refund if we cancel for any reason not listed in the policy, is the Seven Corners Round Trip Basic (CFAR 75%) at $468.60 total cost for both travelers together. This policy provides $100,000 of medical coverage, $250,000 of medical evacuation coverage and gives a 75% refund of trip costs if we cancel for a reason not listed in the policy.

If you cancel for a serious illness or injury, then you would receive a 100% refund. But if there is no reason for you to ordinarily be able to claim, then the Cancel for Any Reason benefit provides 75% back.

We named this the Airline Ticket Hack, and it is a great option instead of paying additional for a refundable airline ticket.

Conclusion

After looking at what Delta Airlines provides for insurance and comparing it to policies found on the open marketplace through sites like CruiseInsurance101, it makes sense to shop for travel insurance instead of simply taking the policy offered during checkout with Delta Airlines. Coverage tends to be more robust, covering more than just the ticket cost and the pricing is basically the same or less.

Does CruiseInsurance101 Charge More?

In the USA insurance is regulated in such a way that the same policy cannot be sold at a lower price. We cover this in our article: Travel Insurance Comparison.

What does this mean to a consumer? It means that the cost of flight insurance that you see through us is the exact same as if you went direct to the insurer. We do not charge a cent more than if you went direct. You cannot get better rates. Give us one minute of your time and let us compare the travel insurance market for you to find the policy that best fits your needs.

So, enjoy your next trip with Delta Airlines. But before you fly, check your travel insurance options.

Safe travels.

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

customer Jeff R

Amanda did a great job assisting making…

Amanda did a great job assisting making process easy...

Susan

Travel Insurance

Patience with customer questions and help with things we do not know. Sylvia was very knowledgeable and helpful, she spent time answering.

Sarah

Christianna was very professional and…

Christianna was very professional and friendly in answering my remaining questions after reading through the policy I had chosen. I chose an IMG plan with the Aardy Logo because Aardy worked with IMG to select the limits of insurance to match their recommendations when traveling internationally and opted to keep benefits within the policy they have learned travelers are typically looking for. It is only available on Aardy and Aardy-powered sites. I have reviewed so many travel insurance plans and found this one gave the coverage I was looking for at the best price.