Seven Corners Travel Medical Insurance For International Travel Including the USA - 2024 Review

Seven Corners Travel Medical Insurance For International Travel

8

Strengths

- Strong Insurance Partner

- Good Medical Coverage

Weaknesses

- No Waiver for Pre-Existing Conditions

- Only For Non-US Travelers

Sharing is caring!

Seven Corners Travel Insurance: What is Travel Medical Insurance?

The Travel Medical Insurance is a customizable policy from Seven Corners Travel Insurance for NON-US citizens for medical only coverage for travel outside their home country (the country where you have your permanent residence) that also includes traveling to the USA. It does NOT provide coverage for trip cancellation and trip interruption but allows the traveler to customize the other plan benefits. Trips up to 364 days can be covered. If less than 364 days is purchased, the trip can be extended with a $5 fee for each extension until the total trip length maxes out at 364 days. There are two (2) versions of the policy – Basic and Plus.

Note: US green card holders may not purchase this insurance.

Travel Medical Insurance Benefits

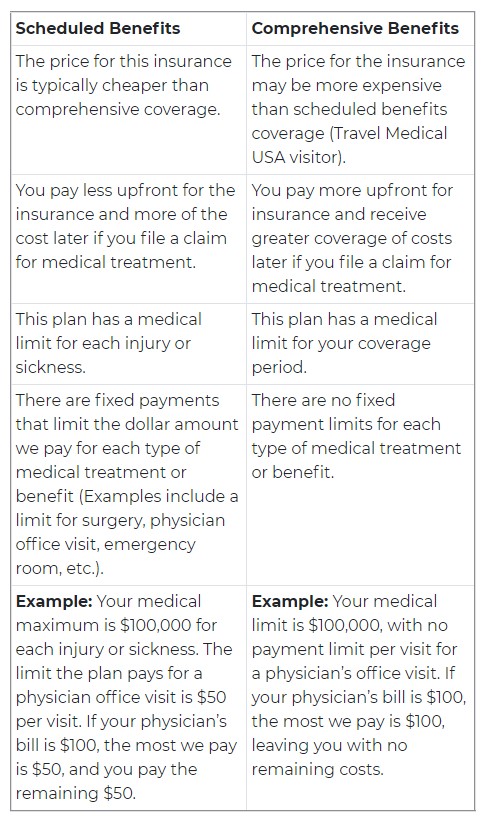

Travelers have a choice of either Scheduled of Comprehensive benefits with both versions of the policy:

The main difference between Scheduled Benefits and Comprehensive Benefits is the amount paid upfront by the travelers – less outlay initially for Scheduled and more outlay for Comprehensive, but greater coverage of costs is provided with Comprehensive.

Also, each treatment has a set capped limit for each injury/illness with Scheduled while Comprehensive has a limit for the entire coverage period.

Premiums will typically be less for choosing Scheduled Benefits as payouts are capped for services rendered for each illness/injury while Comprehensive does not have this cap for services.

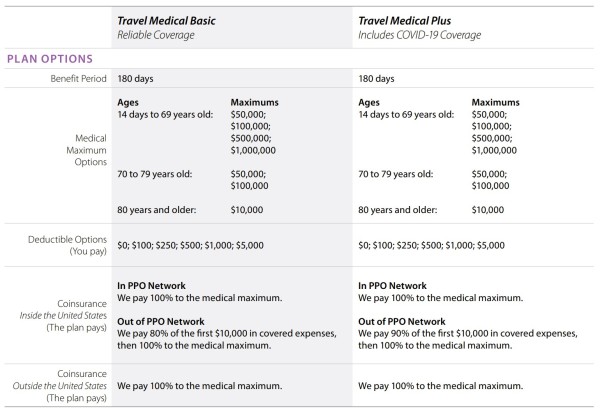

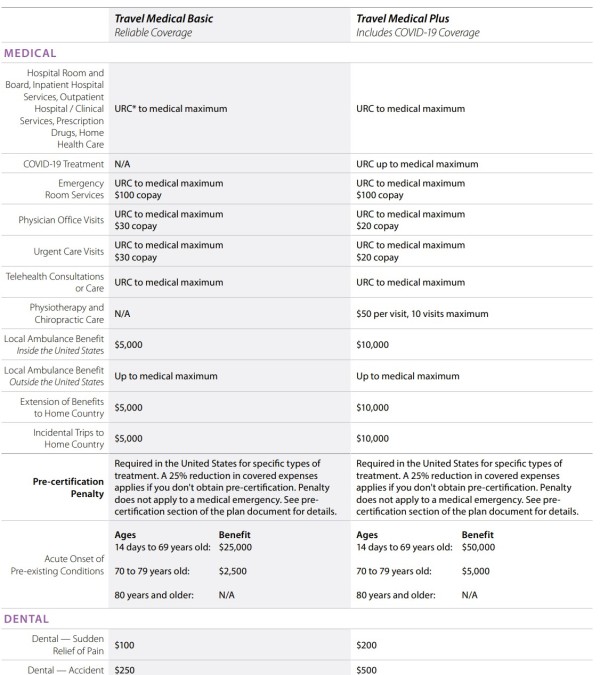

In the tables below the benefits for the Basic version of the policy are listed on the left and the benefits for the Plus version of the policy are listed on the right. Travelers from 14 days old can be covered.

While the Basic plan has many of the same benefits as the Plus plan, it does NOT cover COVID-19, so if this is a concern, the Plus plan should be purchased.

Medical maximum coverage options available with either the Basic or Plus plan are based on age. For ages 14 days to 69 options are $50,000 up to $1 million. Ages 70-79 options are $50,000 or $100,000 and for ages 80+ the maximum is $10,000.

Deductible options for all ages range from $0 - $5,000.

On both plans, when traveling in the US, if services are provided by an IN Network Paid Provider Organization (PPO) then 100% of cost up to the medical maximum is paid. However, if an out of PPO Network provider is used then the Basic plan will pay 80% of the first $10,000 in covered expenses while the traveler pays the remaining 20% of costs. With the Plus plan, the policy pays 90% of the first $10,000 and the traveler pays the remaining 10%. After the $10,000 limit is exceeded, both plans will now pay 100% of costs up to the medical maximum.

Should medical treatment be needed in the US, many treatments will require a pre-certification to be obtained. The traveler must notify Seven Corners and receive instructions on the pre-certification process and notify all doctors, hospitals etc. that the insurance requires pre-certification. If the pre-certification is not obtained, a 25% reduction in benefits applies except in a medical emergency.

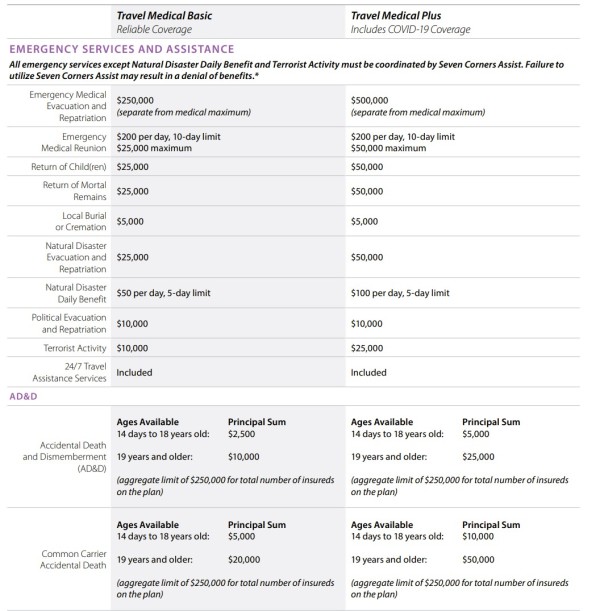

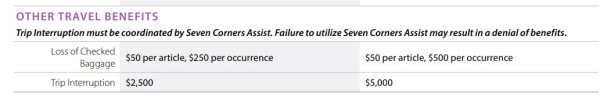

For most medical services, the Plus plan provides double the amount of coverage over the Basic plan. However, both provide $10,000 for political evacuation and repatriation back to the traveler’s home country. Both plans also can cover adventure activities (for an additional premium) up to the maximum medical amount.

24/7 Travel Assistance Service is included (provided by Seven Corners Assist).

The plans offer a directory of medical providers, medical assistance services and COVID-19 coverage on the Plus plan up to the medical maximum selected.

Conclusion

For non-US travelers needing medical coverage while traveling outside their home country and including travel within the US, this policy can be a good choice, The plans are customizable and reasonably priced.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

customer Jeff R

Amanda did a great job assisting making…

Amanda did a great job assisting making process easy...

Susan

Travel Insurance

Patience with customer questions and help with things we do not know. Sylvia was very knowledgeable and helpful, she spent time answering.

Sarah

Christianna was very professional and…

Christianna was very professional and friendly in answering my remaining questions after reading through the policy I had chosen. I chose an IMG plan with the Aardy Logo because Aardy worked with IMG to select the limits of insurance to match their recommendations when traveling internationally and opted to keep benefits within the policy they have learned travelers are typically looking for. It is only available on Aardy and Aardy-powered sites. I have reviewed so many travel insurance plans and found this one gave the coverage I was looking for at the best price.