Trawick First Class Travel Insurance - 2024 Review

Trawick First Class Travel Insurance Plan - Review

8

Strengths

- Reputable Insurance Partner

- Strong Medical Insurance and Medical Evacuation

- Pre-Existing Medical Condition Exclusion Waiver

- Cancel For Any Reason option

Weaknesses

- None – Robust Comprehensive Policy

Sharing is caring!

About Trawick

Trawick International is a full-service travel insurance provider specializing in travel-related coverage for tourists, students, scholars, businesses, groups, and all other globe trekkers. With their brand line of “Anywhere starts here”, Trawick has renewed their commitment to global travel with a variety of policies to suit any travel situation.

For the third year running, Trawick has been named one of the best travel insurance companies by Forbes Advisor. Trawick continues their high standard of providing excellent travel coverage and customer support to their customers.

Trawick is a coverholder at Lloyd’s and joins an elite group of insurance companies within this syndicate. The policies themselves are underwritten by Nationwide Mutual Insurance Company and administered by Co-ordinated Benefit Plans.

Trawick is a travel insurance partner with CruiseInsurance101 and we’re proud to be able to offer several of their policies to travelers including the First Class policy.

For more information on Trawick International, visit their website at: www.trawickinternational.com.

Let's look at the Trawick First Class Trip Insurance plan benefits.

Trawick First Class Trip Insurance

The Trawick First Class Travel Insurance policy protects your trip investment and covers emergency accident and sickness expenses.

The First Class plan is great for domestic or international destinations and has excellent benefits and coverage. Below is an overview of the benefits:

We always advise that travelers carry at least $100,000 of Emergency Medical Insurance and at least $250,000 of Emergency Medical Evacuation when traveling overseas. Our recommendation provides reasonable coverage if severe illness or injury occurs, or if medically necessary transportation back home is needed.

We also encourage all travelers to consider a policy with a Medical Waiver. These waivers allow the plan to cover Pre-existing Medical Conditions. Without a waiver, travel insurance excludes Pre-existing Conditions.

When a travel insurance plan offers a Waiver of Pre-existing Conditions, it is provided in the policy at no extra cost. The waiver is automatically included when you buy travel insurance promptly after your first trip deposit or payment.

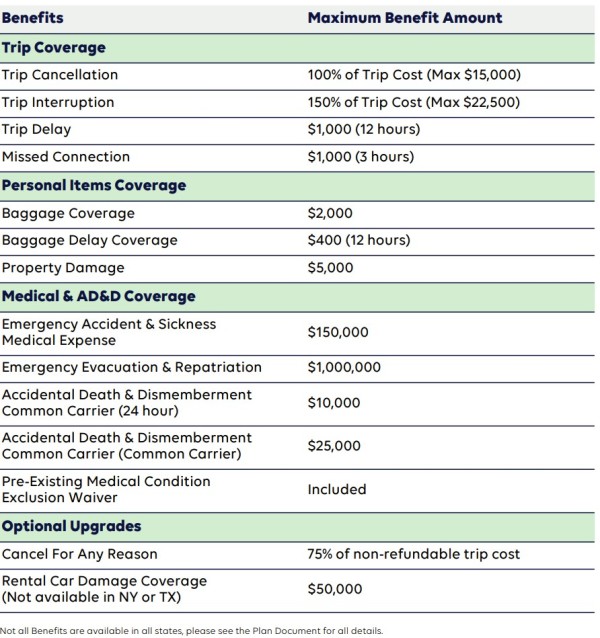

Trawick First Class Travel Insurance Benefits

Maximum Limits Per Person

Trip Cancellation - 100% of Trip Cost Up to $15,000*

Trip Interruption - 150% of Trip Cost up to $22,500**

Travel Delay - $1,000 ($200 per day after an initial delay of 12 hours or more)

Missed Connection - $1,000 (after an initial common carrier delay of 3 hours)

Baggage & Personal Effects - $2,000

Baggage Delay - $400 (after an initial delay of 12 hours)

Property Damage - $5,000

Accident & Sickness Medical Expense - $150,000

Emergency Medical Evacuation - $1,000,000

Accidental Death & Dismemberment - $10,000 anytime; $25,000 common carrier

Pre-existing Condition Waiver Available - if purchased within 14 days of your Initial Trip Payment or Deposit

Medical Coverage Type - Secondary – Pays AFTER any primary coverage is exhausted

Cancel For Any Reason (optional) – Reimburses 75% of trip cost. Must be purchased within 14 days of initial trip payment or deposit (Not available in NY or WA)

Rental Car Damage Coverage (optional) - $50,000. Provides collision coverage only for rental car. Liability coverage not included. (Not available in NY or TX)

10-Day Free Look – Take 10 days to review the policy and see if it’s right for you. If not, the policy can be canceled during this time and premium refunded. (Not available in WA or NY)

Trawick Travel Insurance - First Class - Covered Perils

Emergency Sickness/Illness/Injury/Death - Yes

Hijacking, Medical Quarantine, Subpoena or Jury Duty - Yes

Home uninhabitable due to fire, flood, burglary, or Natural Disaster - Yes

Direct involvement in a documented traffic accident while en route to your departure - Yes

Organized Labor Strike - Yes

Terrorist Incident - Yes

Inclement Weather and Natural Disaster - Yes

Revocation of previously granted military leave - Yes

Financial Default of Travel Supplier - Yes

Theft of passport or visa that prevents departure - Yes

Mandatory evacuation ordered by government authority due to adverse weather and Natural Disaster – Yes

Trawick Travel Insurance - First Class - Additional Information

Maximum Trip Duration - 90 days (30 days for travelers aged 80+)

Maximum Traveler Age - no maximum age limit

Pre-Existing Condition Review Period - 60 days

Premium Refunds - You may submit a cancellation request and receive a full refund within 10 days from the effective date of your coverage***

Latest date plan can be purchased - 1 day before departure

24/7 Emergency Travel Assistance - Included

This is only a summary of the Trawick First Class program. Please read the policy carefully to fully understand the coverages, terms, conditions, limits, and exclusions. Not all plans or coverages are available in every state. This summary does not replace or change any part of your policy. If there is a conflict between this summary and the policy, the policy will control.

Premium is based on the traveler's age and the trip cost. Rates are subject to change at any time.

You can purchase the plan at any time, but you are only eligible for Cancel For Any Reason if you purchase it within 10 days of the Initial Trip Deposit. Other benefits will apply as per the terms and conditions of the policy.

*The trip cancellation benefit is determined by the amount of your trip you elect to protect, up to the maximum benefit stated above.

**The trip interruption benefit is determined by the amount of trip cancellation benefit purchased. All benefits are per insured person.

Frequently Asked Questions

What if I buy the policy and decide the coverage isn't right for me?

If you are not completely satisfied with the travel insurance you have purchased, you can call to cancel within 10 days of the effective date. Trawick Travel Insurance will cancel the policy and refund your premium as long as you have not yet departed on your trip, nor submitted a claim.

This refund policy is known as the Free-Look Period. The Free-Look benefit is currently not available in NY or WA.

What does travel insurance provide?

Travel Insurance provides emergency assistance services if you have a problem during your trip. Travel Insurance covers the unexpected costs such as having to cancel or interrupt your trip due to unforeseen reasons, such as the illness of you, a family member, or a travel companion, severe weather, missed connections, strikes, default of travel supplier and other unexpected events that may arise before or during your trip. Plans include trip cancellation and interruption, accident and sickness with assistance services, medical repatriation, baggage coverage, accident insurance, travel accident insurance, and many other benefits.

If I already have medical coverage, why do I need to pay for it again within travel insurance coverage?

Travel Medical Expense is designed to cover expenses for accidental injury and sickness occurring on your trip. This benefit provides coverage for medically necessary care that may not be covered on your health insurance plan.

You should check with your health insurance provider to verify if you are covered outside of the plan area or the US. This travel insurance also includes valuable 24/7 emergency assistance to aid with locating medical care, medically necessary transportation, and arranging payment for medically necessary care.

Besides medical, what other assistance is provided?

If your trip is extended on the order of a physician due to an illness or accidental injury incurred while traveling, the policy may cover hotel and meal expenses under the Trip Delay benefit, as well as additional airline transportation costs.

Travel assistance services can also help you with many other tasks, such as arranging for forgotten or damaged prescription medication, locating an English-speaking doctor, and ensuring you are receiving the right care for a medical emergency.

The multilingual assistance staff can provide you with helpful information and advise you where to go if you lose your passport, need cash or legal services at your destination.

What is a Pre-existing Condition?

A Pre-existing medical condition means any accidental injury, sickness, or disease you, your traveling companion, or your family member booked to travel with you has for which medical advice, diagnosis, care, or treatment was recommended or received within 60 days prior to the policy effective date. In other words, any change in your health history in the past 60 days prior to policy purchase.

Illnesses or conditions controlled with medication where the dosage or prescription hasn’t changed in the 60-day period ending on the effective date are considered stable and not considered pre-existing conditions.

Can the Pre-Existing Condition Exclusion be waived?

Yes. The Pre-Existing Conditions exclusion is waived if You (a) purchase the policy within fourteen (14) days of the initial deposit or payment on your trip; (b) purchase the policy for the full cost of Your Trip, and (c) are medically able to travel on the Effective Date.

What events are covered under Trip Interruption?

Typically, an insured can interrupt their trip for the same or similar reasons as they can for canceling their trip. Trip Interruption differs because it provides coverage once you depart for your covered trip.

The insured will be reimbursed for prepaid, unused, and non-refundable travel arrangements plus additional transportation costs to catch up to their trip or return home early.

Is baggage loss covered?

The company will reimburse you up to $2,000 (the maximum benefit shown on the confirmation of coverage), if you sustain loss, theft or damage to baggage and personal effects during the trip, provided you have taken all reasonable measures to protect, save and/or recover the property. The baggage and personal effects must be owned by you and accompany you during the trip. The police or other authority must be notified within twenty-four (24) hours in the event of theft.

This coverage is subject to any coverage provided by a Common Carrier.

There will be a per article limit shown on the Confirmation of Coverage.

Similar to homeowners’ policy personal property coverage, there is a combined Maximum Benefit limit shown on the Confirmation of Coverage for the following: jewelry; watches; articles consisting in whole or in part of silver, gold or platinum; furs; articles trimmed with or made mostly of fur; cameras and their accessories and related equipment.

The company will pay the lesser of the following:

(a) Actual Cash Value at time of loss, theft or damage to baggage and personal effects; or (b) the cost of repair or replacement in like kind and quality.

What does Baggage Delay cover?

The company will reimburse you for the expense of necessary personal effects, up to the Maximum Benefit shown on the Confirmation of Coverage, if Your Checked Baggage is delayed or misdirected by a Common Carrier for more than twelve (12) hours, while on a trip.

You must be a ticketed passenger on a Common Carrier.

Additionally, all claims must be verified by the Common Carrier, who must certify the delay or misdirection and receipts for the purchases must accompany any claim.

What does the Travel Delay cover?

The company will reimburse you for covered expenses on a one-time basis, up to the maximum benefit shown on the confirmation of coverage, if you are delayed, while coverage is in effect, en route to or from the trip for twelve (12) or more hours due to a defined hazard.

Covered Expenses:

- Any prepaid, unused, non-refundable land and water accommodations.

- Any additional expenses incurred.

- An economy fare from the point where you ended your trip to a destination where you can catch up to the trip; or

- A one-way economy fare to return you to your originally scheduled return destination.

Can I buy travel insurance after an incident has occurred?

Unfortunately, no. Travel insurance coverage applies only to unforeseen issues that occur after the policy is in effect. Insurance does not cover events that are no longer unexpected or unforeseen.

What is considered an Accident?

An accident is defined as a sudden, unexpected, unusual, specific event that occurs at a specific time and place during the covered trip and also includes a mishap to a method of transport in which you are traveling.

Are there any coverage exclusions?

Yes. The complete list of coverage exclusions are summarized in the certificate. Please read the certificate carefully and note all exclusions and state exceptions that may apply.

When does the coverage begin?

All coverage except trip cancellation and optional trip cancellation for any reason will begin on the scheduled departure date, or the actual departure date if a change is required by a common carrier (or an alternate travel arrangement if required to reach your trip destination). Coverage will not begin before the effective date shown on your purchase confirmation.

Trip cancellation and optional trip cancellation for any reason coverage will begin on your effective date. No coverage can be purchased after a person departs on a trip.

What is AD&D – Air only?

The company will pay benefits for accidental injuries resulting in a loss as described in the table of losses listed in the policy, that occur while you are riding as a passenger in or on, boarding or alighting from, any air transportation operated under a license for the transportation of passengers for hire during the trip. The loss must occur within one hundred eighty (180) days after the date of the accident causing the loss. The principal sum is shown on the schedule of benefits.

Complete details of coverage terms, limitations, and exclusions that may affect benefits payable are summarized in the certificate. Please read the certificate carefully and all state exceptions that may apply.

How can a traveler get assistance while on a trip?

For 24/7 Travel Assistance Services Only:

Call Toll-free: 855-464-8974 (Within the United States and Canada)

Or Call Collect: 603-328-1361 (From all other locations)

How do I file a claim with Trawick?

Written notice of a claim must be given by the claimant (either You or someone acting for You) to the company or its designated representative within seven (7) days after a covered Loss first begins.

Notice should include Your name and the Plan number. Notice should be sent to the company's administrative office, at the address shown on the cover page of the policy, or to the company's designated representative.

You can download claim forms on Trawick's website: https://www.trawickinternational.com/claim-information/claim-forms

For Claim Status, please contact 888-352-3169 or use the Claims Portal.

Email: NWTravClaims@cbpinsure.com

Mail claim form and all necessary documents to:

Can I purchase this plan cheaper directly through Trawick International?

No, US law prohibits different pricing for the same policy, so you can rest assured that the price you see is the lowest price possible.

Conclusion

We find Trawick First Class Travel Insurance is a robust mid-range policy and worth considering for either domestic or international travel.

It includes ample Medical Insurance ($150,000) and Medical Evacuation ($1,000,000), a Pre-existing Condition Waiver, and a generous list of Cancellation and Interruption reasons.

The insurance also includes toll-free, 24/7 multilingual emergency assistance services to help arrange any care you may need while you are away from home.

CruiseInsurance101 – Travel Insurance Marketplace

CruiseInsurance101 is a travel insurance marketplace, which means that we compare your travel insurance options through multiple insurers. We are very selective about the plans we offer on our site.

You'll always find the lowest possible price and value right here at CruiseInsurance101.

Visit CruiseInsurance101 first to see your options before committing to the first travel insurance policy you're offered. Stop by and chat, send an email, or give us a call at +1(786) 751-2984.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

customer Jeff R

Amanda did a great job assisting making…

Amanda did a great job assisting making process easy...

Susan

Travel Insurance

Patience with customer questions and help with things we do not know. Sylvia was very knowledgeable and helpful, she spent time answering.

Sarah

Christianna was very professional and…

Christianna was very professional and friendly in answering my remaining questions after reading through the policy I had chosen. I chose an IMG plan with the Aardy Logo because Aardy worked with IMG to select the limits of insurance to match their recommendations when traveling internationally and opted to keep benefits within the policy they have learned travelers are typically looking for. It is only available on Aardy and Aardy-powered sites. I have reviewed so many travel insurance plans and found this one gave the coverage I was looking for at the best price.